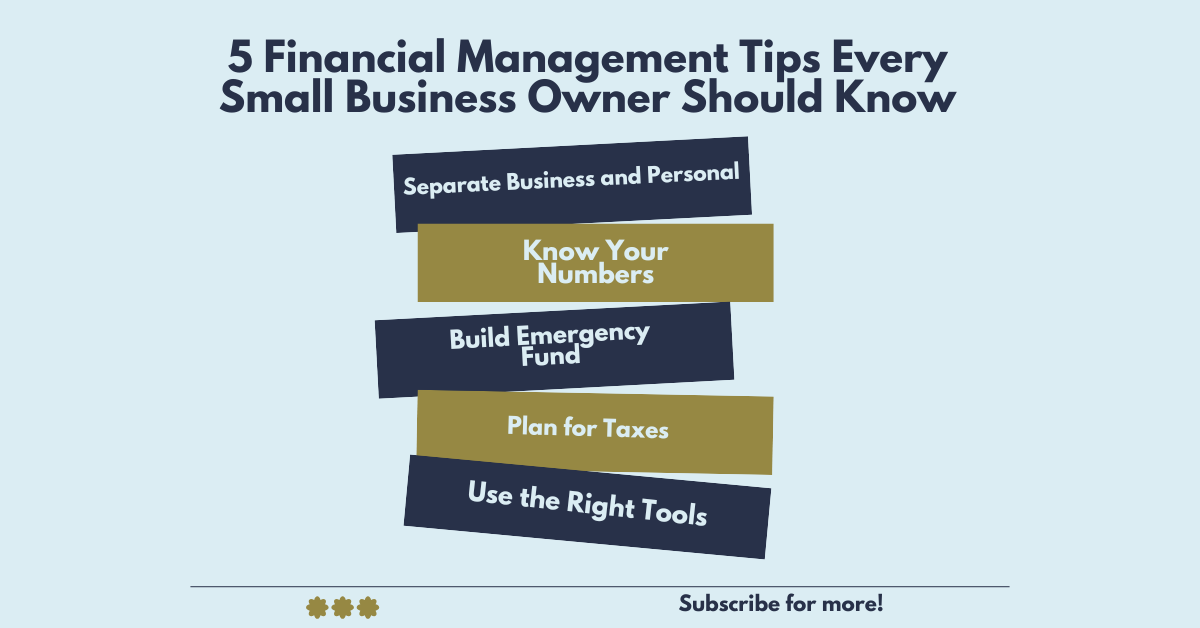

Running a business means wearing a lot of hats, but managing your finances well is one you can’t afford to drop. Here are five foundational tips every business owner should implement:

1. Separate Business and Personal Finances

Mixing your accounts leads to messy books and tax headaches. A business account is essential for clarity, budgeting, and building business credit.

2. Know Your Numbers

Track your cash flow, profit margins, and expenses. Regular reviews (monthly or quarterly) help you stay ahead of issues.

3. Build an Emergency Fund

Business isn’t always smooth. Set aside a portion of your revenue to protect yourself during slow months or unexpected hits.

4. Plan for Taxes Year-Round

Don’t let tax season sneak up on you. Set aside a percentage of your income and consider working with an accountant.

5. Use the Right Tools

Use accounting software like QuickBooks, Xero, or Wave to automate invoices, track expenses, and generate reports.

Pro tip: A solid financial foundation makes it easier to qualify for funding when you need it. At Enrado Capital, we can help you prepare.